Electric cars attract lower insurance prices as drivers back away from petrol and diesel vehicles

Drivers across the UK can save nearly £300 on car insurance through electric vehicle prices

Don't Miss

Most Read

Certain electric vehicle drivers could secure cheaper car insurance through purchasing popular cars, according to new reports.

Reports revealed that young drivers in Birmingham, Liverpool, Nottingham and Edinburgh can secure cheaper car insurance by choosing an electric vehicle over traditional petrol cars.

Research detailed how prices for car insurance differ depending on location, with Edinburgh offering the most significant savings.

For drivers under 25 who have held a licence for less than two years, they could pay roughly £294 less annually to insure an electric car compared to a fuel vehicle.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Certain drivers can save nearly £300 on car insurance through electric vehicles

| PA/GETTYThe findings challenge the conventional wisdom that electric vehicles are always more expensive to insure. In Edinburgh, young drivers pay an average of £1,278 yearly for EV insurance versus £1,572 for petrol cars.

Birmingham drivers can also save £181, while those in Nottingham and Liverpool see reductions of £117 and £57 respectively.

Edinburgh was found to lead the way for the cheapest EV car insurance, with young drivers paying £1,278 annually for electric car insurance compared to £1,572 for fuel cars.

Birmingham follows with EV insurance costing £1,628 versus £1,809 for petrol vehicles, while Nottingham residents pay £1,395 for electric compared to £1,512 for conventional cars.

Liverpool showed the smallest difference with EV insurance priced at £1,907 against £1,964 for petrol and diesel vehicles.

But reports found that London still remains the most expensive location for young EV drivers at £2,855 annually, while Brighton follows at £2,225, with both regions significantly above the national average.

While electric vehicles remain more expensive to insure on average, the gap is narrowing, with data showing that the average EV premium for someone under 25 is £1,881, compared to £1,621 for fuel cars.

The data by MoneySuperMarket recorded a 14 per cent increase in electric car insurance policies purchased through its platform in the first quarter of 2025, compared to the same period in 2024.

LATEST DEVELOPMENTS:

- M23 chaos: Drivers told to expect delays as major motorway closes near Gatwick Airport due to overrun roadwork

- Nissan to bring electric car manufacturing of popular model to UK’s largest car plant - 'Built in Britain!'

- Motorists face massive blow as Dartford Crossing increases fees by 40% for first time in 11 years

Car insurance across London remains the most expensive in the UK

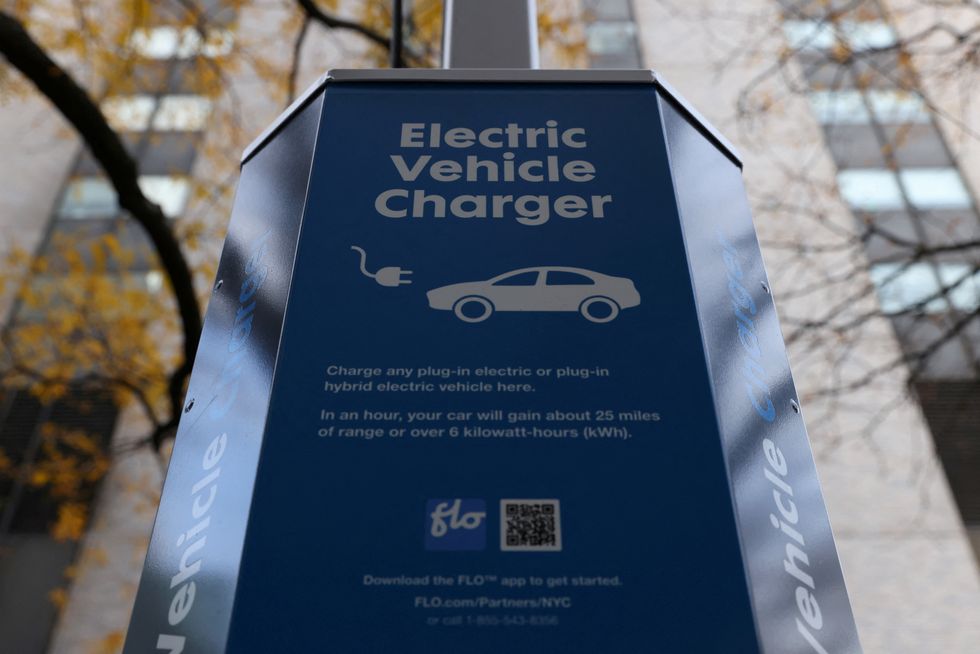

| GETTYThe difference in pricing between EVs and fuel vehicles comes at a crucial time for the UK, which has been leaning heavily towards electric cars.

It also follows the Zero Emission Vehicle mandate, which requires all new car sales to be electric by 2030, with at least 28 per cent of sales electric this year. But while more people have been purchasing EVs, the higher price point and vehicle costs have been putting people off.

The comparison site found that cheaper insurance was the top factor for encouraging young drivers to switch to electric vehicles.

The report shared how almost half of under-25s aspire to drive an electric car, with environmental concerns playing a significant role in their vehicle preferences compared to other age groups.

The report found that young drivers can save money on car insurance by going electric

| REUTERSThe data reveals that more than one in three young drivers (38 per cent) refused to drive a petrol or diesel car as their first vehicle due to environmental harm.

This shift in attitudes comes as the insurance landscape evolves to favour electric vehicles in certain locations, potentially accelerating the transition to greener transport options among younger generations.

Insurance premiums are calculated using multiple factors beyond just the type of vehicle, with age remaining as the primary determinant. Due to this parameter, younger drivers are facing substantially higher costs due to perceived inexperience.

Location significantly impacts pricing, with areas experiencing higher crime rates typically seeing increased premiums.