Drivers urged to 'make sure no car tax will need to be paid' ahead of major changes next year

One organisation urged their members to ensure they are clear on the rules

Don't Miss

Most Read

Latest

Drivers are being warned to check their car tax ahead of changes launching next year as experts call on motorists to be cautious of the new rules.

From April 1, 2025, owners of electric cars and low emission vehicles will need to pay Vehicle Excise Duty (VED) in the same way as petrol and diesel owners.

This is being done to ensure the system of vehicle taxation for all Britons is "fair", as highlighted by former Chancellor Jeremy Hunt in the 2022 Autumn Statement.

While this will mean many drivers will have to pay more to keep their vehicles on the road, they will still be paying less than the majority of petrol and diesel car owners.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

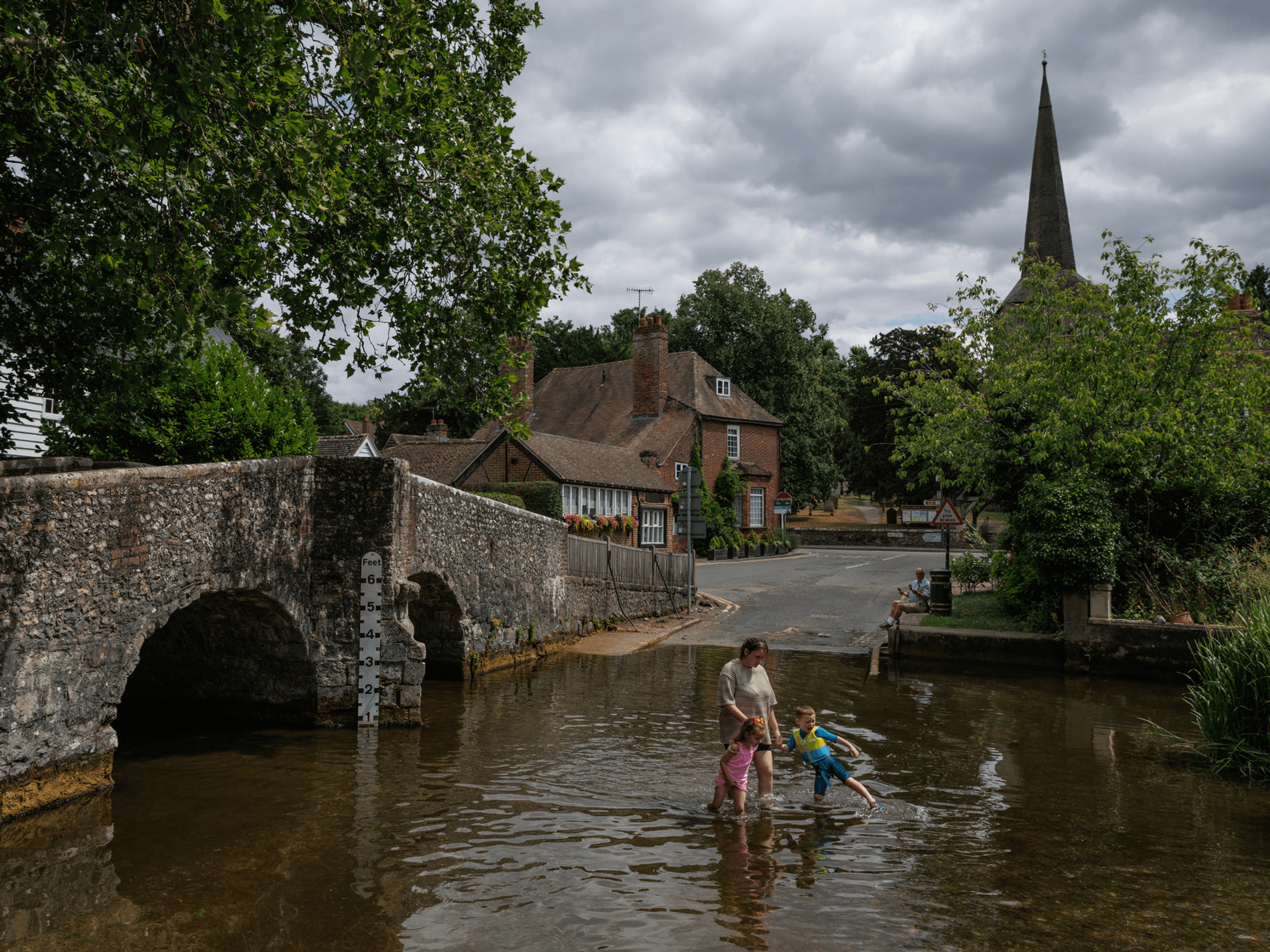

Car tax changes will be launching in April next year

| X/DVLAExperts are noting that some exempt vehicles will still qualify as exempt after the April 2025 deadline, despite the changes.

The Driver and Vehicle Licensing Agency (DVLA) is advising motorists to make sure these vehicles are in the correct tax class.

The British Vehicle Rental and Leasing Association (BVRLA) has urged motorists to ensure they are aware of the rules.

It stated: "Members should ensure that any electric NHS, police, and fire service vehicles that they are the registered keeper for, are in the correct exempt tax class.

"This is to make sure no tax will need to be paid for these vehicles after April 2025. They may have previously been taxed as electric vehicles."

According to the V355/1 DVLA document which outlined tax classes, there are a number of exempt vehicles seen on the roads.

This includes "Limited use" vehicles, vehicles used by a disabled person, disabled passenger vehicle, historic vehicles, National Health Service vehicles and crown vehicles.

Historic vehicles are exempt from paying car tax if they are older than 40 years old, although the vehicle must still be taxed, even if they don't have to pay.

Crown vehicles are defined as those owned by, or or on contract hire or loan, to a Government Department and used for official purposes.

Disabled passenger vehicles are subject to annual taxing, although before taxing, the DVLA must establish that the application is from an organisation recognised by the Secretary of State as being concerned with the care of disabled people.

This must be supported by a declaration from the organisation on headed paper that the vehicle is being solely used for the purpose of carrying disabled passengers.

LATEST DEVELOPMENTS:

Classic cars need to be over 40 years old to be exempt from vehicle tax | GETTY

Classic cars need to be over 40 years old to be exempt from vehicle tax | GETTYLimited use applies to a vehicle used solely in connection with agriculture, horticulture or forestry and its road travel does not exceed 1.5km each trip between different areas of land occupied by the same person.