Father and son slapped with prison sentences for 'exploiting' drivers in £60k fake car insurance scam

The family were operating a fake car insurance scheme which stole thousands from drivers in fake policies

Don't Miss

Most Read

Motorists have been warned to only buy car insurance from reputable sites to avoid losing out on thousands due to fraudulent cases.

The warning follows a recent case which saw a Leicester father and son sentenced for operating a fraudulent car insurance scheme that netted more than £60,000, with a third family member convicted for attempting to obstruct the police investigation.

The father was jailed for 21 months after admitting to selling fake insurance policies through a practice known as "ghost broking" between August 2016 and January 2020.

His son, however, received a suspended sentence for laundering nearly £12,000 of the proceeds from fake insurance policies.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

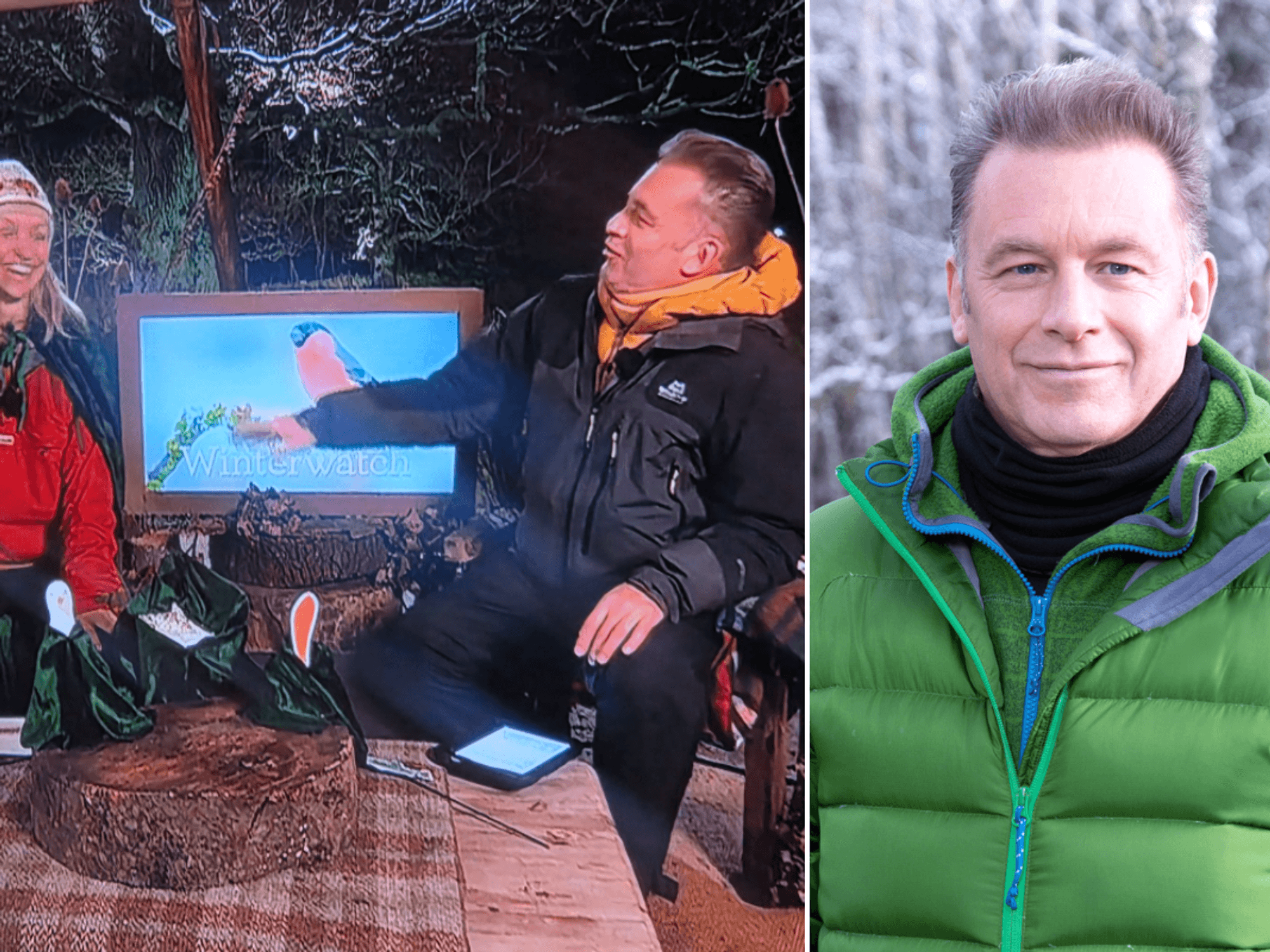

The father and son were sentenced for "ghost broking" offences

|GETTY

The City of London Police's Insurance Fraud Enforcement Department (IFED) uncovered that the father had pocketed £61,763 through his ghost broking activities. He charged victims between £200 and £300 to arrange low-cost car insurance policies.

His scheme involved providing false information to insurers, including forged employment letters from a company called Eastern Catering.

These letters falsely claimed that policyholders had worked for the company for several years without any road traffic collisions or insurance claims.

The Insurance Fraud Bureau referred the case to IFED after linking the father to 52 fraudulent motor insurance policies across four different insurers.

Despite earning over £60,000 from the fraud, HMRC records revealed that only £27,366 in total earnings between 2016 and 2020 was declared.

The fraudulent policies left victims completely uninsured and exposed to serious legal consequences, the bureau detailed.

Detective Constable Dan Weller from IFED shared: "'Ghost brokers' leave their victims uninsured and vulnerable to fines, points on their license, and even having their car seized. Ilyas showed no qualms in exposing his victims to these consequences for his own financial gain."

The false information meant that all policies issued by the family were invalid, with many cancelled by insurers who suspected fraud.

LATEST DEVELOPMENTS:

- Motorists of all car types could make £1,000 yearly as Labour relaxes key planning rules - 'Boost income'

- Self-driving cars confirmed for UK roads next year with motorists able to hire driverless taxis

- Driving licence changes launching today will see millions of British motorists impacted by new rules

The family charged drivers lower costs for fake car insurance premiums (stock image)

|GETTY

According to police, analysis of the son’s phone showed that he had exchanged messages related to insurance with at least 31 contacts from October 2015 to March 2021.

When drivers looking for policies messaged the son to request quotes, he would state that his father arranged the cover and would come back to them with a cost the following day.

If a quote was finalised, the family would then ask drivers to visit the office to set up their policy or send a photo of their bank card to ensure payment could be processed.

The move meant that victims believed they had legitimate insurance coverage, unaware that the discounted premiums came at the cost of fabricated employment histories and false no-claims bonuses. IFED's financial investigators will now pursue confiscation proceedings to recover the proceeds of crime.

The fraudulent practice saw the father and son rake in more than £60,000 in fake car insurance policies

| GETTYWeller stated: "The upcoming confiscation proceedings should send a clear message that IFED will use its full suite of options to ensure that 'ghost brokers' do not benefit from criminal activity."

Meanwhile, John Davies from the Insurance Fraud Bureau explained that the father and other family members were able to "exploit innocent members of the public" while pocketing thousands of pounds by "selling sham car insurance that left devastated victims uninsured and out of pocket".

Davies added: "We're pleased justice has been served against this family for the role they all played in this reckless fraud scheme.

"Ghost broking remains a serious threat, and we continue to work closely with police and insurers to protect consumers. We encourage anyone with evidence of insurance fraud to report it to our confidential CheatLine."