Inflation expected to hit four per cent in September – what it means for your pensions, savings and mortgage

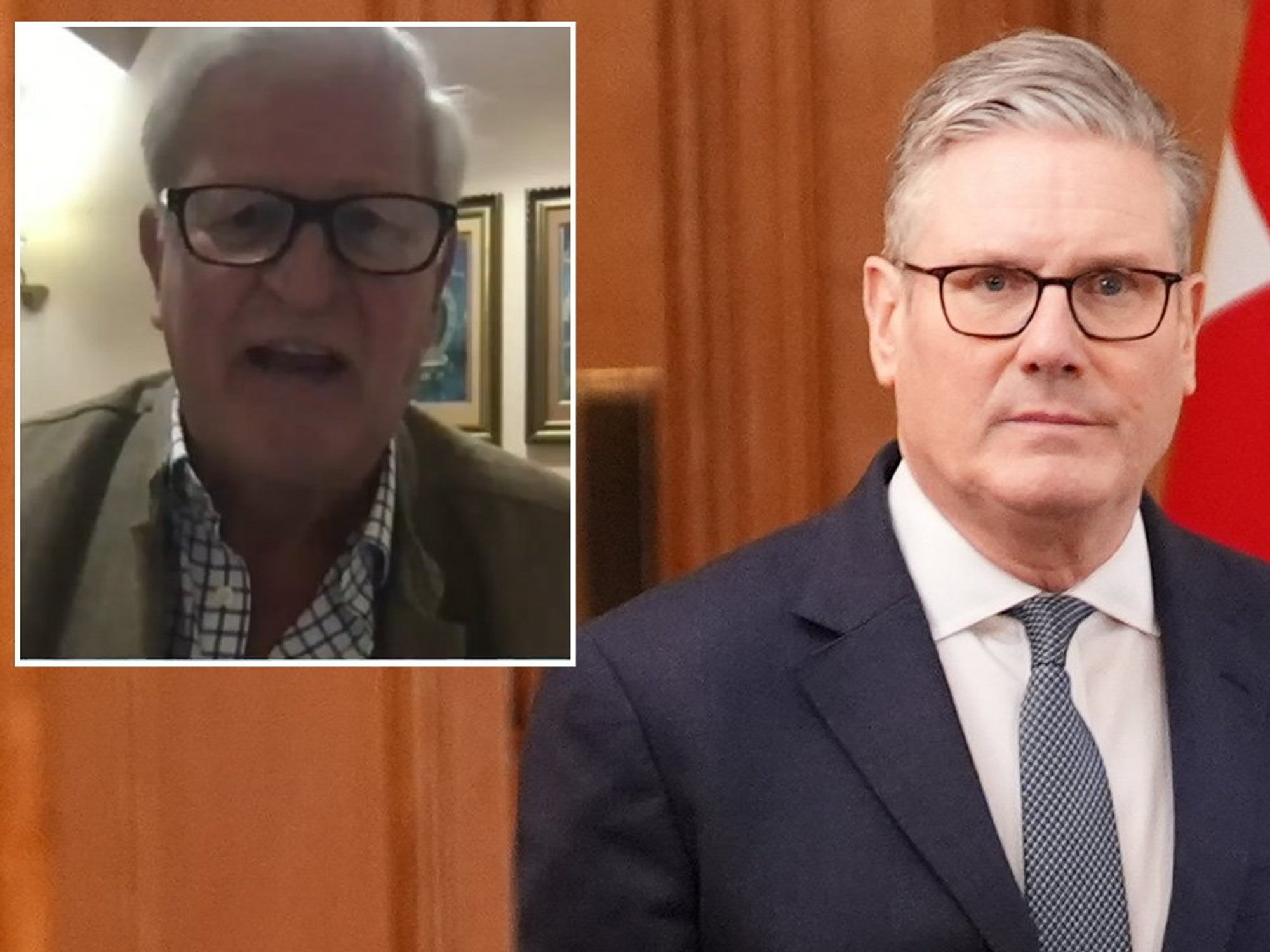

Britain on the brink as Liam Halligan warns ‘we are a global outlier’ in dismal inflation warning |

GBNEWS

Rising prices and frozen interest rates mean key decisions ahead for mortgages, savings and pensions

Don't Miss

Most Read

Households are bracing for another spike in inflation, with price rises expected to peak at four per cent in September.

The jump could mean higher costs linger for longer, leaving borrowers waiting months for relief and forcing savers and pensioners to rethink their money plans.

The Bank of England is widely expected to hold interest rates at four per cent when it meets next week.

Markets do not believe cuts will come before Christmas, raising big questions for anyone with a mortgage, cash savings or approaching retirement.

Inflation and interest rates

Inflation rose to 3.8 per cent in July and is expected to edge higher again in August before hitting a peak of four per cent in September.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: "Just like the weather, the temperature for inflation looks set to have been steamy in August.

"With food and grocery prices still on the boil there’s not likely to have been much cooling off. As people ringfence budgets for small treats, spending on entertainment, holidays and favourite foods is likely to have kept upwards pressure on the Consumer Prices Index."

Ms Streeter added: "Inflation is expected to peak at four per cent this month, before starting a downwards drift. Even though we’re expecting bad news from the employment market, with every chance of more weakness everywhere from unemployment to vacancies, the Bank isn’t keen to cut at a time when inflation remains so stubborn.

"So, borrowers look set to need lots more patience, given another interest rate cut is not likely this month or even by the end of the year."

Britons have been forced to contend with record high inflation | GETTY

Britons have been forced to contend with record high inflation | GETTY Markets do not expect another reduction until March. Ms Streeter said this would keep gilt yields higher, "and cause continued headaches for the government, given it means borrowing costs stay elevated, keeping the public finances in a more fragile state."

What it means for savings

After years of turbulence, savings rates are finally starting to settle.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: "The savings market is tipping back towards normality. We’ve hit a peculiar juncture, where the most competitive deals across the board are all pretty similar."

She explained: "We’ve come through a long period where high interest rates in the short term were expected to be followed by cuts, so the best deals were available on easy access savings. Now rates are lower, and fell again last month, and because the easy access market is particularly sensitive to cuts, the best deals in this part of the savings market have fallen."

After years of turbulence, savings rates are finally starting to settle

| GETTYFixed-rate savings accounts have proved more resilient. Ms Coles explained that while the flexibility of easy access accounts can be appealing, locking into a fixed rate provides certainty at a time when interest rates are expected to fall further. She said that savers with money they will not need immediately may benefit from fixing now, while deals of around 4.5 per cent are still available.

What it means for mortgages

Mortgage borrowers may see some relief, though not dramatic falls.

The average two-year fixed rate has slipped below 5 per cent, down from 5.2 per cent four months ago, according to Moneyfacts. But the Bank’s decision to hold rates means lenders are likely to move cautiously.

Hargreaves Lansdown’s Savings and Resilience Barometer found those who have recently remortgaged pay £88 more a month than those who have not, with almost three times as much of their borrowing on variable rates.

Ms Coles said that although remortgaging has been "horribly painful" since rates began rising in 2022, the process "could be less painful in the coming months" as deals stabilise.

What it means for pensions and annuities

Retirees are watching closely as the triple lock sets up another bumper increase to the state pension.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: "It’s an important time of year for retirees with a slew of data due out in the coming weeks that will define how much the state pension will increase by next year."

Inflation currently stands at 3.8 per cent and wages at 4.6 per cent. Ms Morrissey explained: "Only time will tell which will be higher but if the highest figure proved to be 4 per cent for instance, then that would see the value of the full new state pension boosted by close to £500 a year."

However, she warned: "Those in receipt of top ups such as the state second pension will find those elements rise in line with inflation rather than the triple lock – this is fine if inflation proves to be highest figure but if it’s beaten by wages then overall their state pension increase will be slightly lower."

Retirees are watching closely as the triple lock sets up another bumper increase to the state pension

| GETTYFor those considering annuities, the outlook is more positive. Ms Morrissey said incomes remain strong: "The latest data from the HL annuity comparison service shows that a 65-year-old with a £100,000 pension could get up to £7,793 per year from a single life level pension with a five-year guarantee."

She added: "Interest rates are one factor impacting annuity rates and so the expected hold should mean incomes remain pretty solid and interest will continue to be high."